The cost of living in the UK has been influenced by various factors, including inflation rates, housing costs, and energy prices. Here’s a summary of the current situation as of 2024:

Inflation and Prices

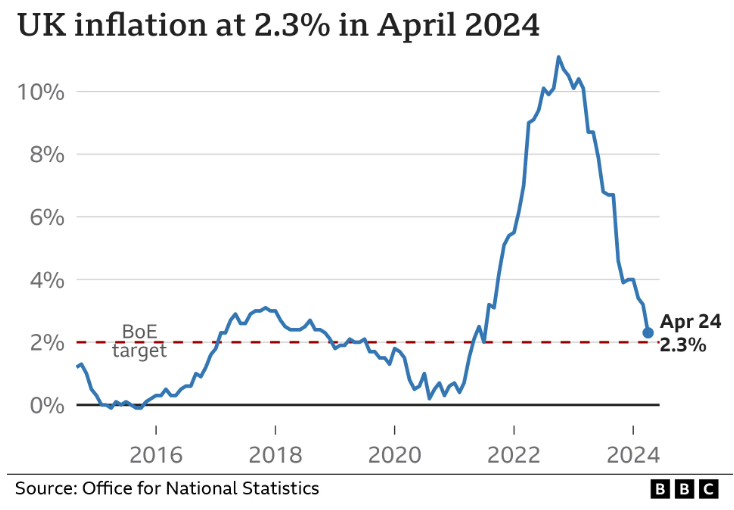

Inflation has been a significant issue in recent years, with food and energy prices driving the cost of living higher. In April 2024, the annual inflation rate was 2.3%, down from higher rates seen in previous years. Food prices, which saw a peak increase of 19.1% in March 2023, have now moderated, with a 2.9% increase reported in April 2024. Energy prices have also decreased significantly, with gas prices falling by 37.5% and electricity prices by 21.0% over the past year (House of Commons Library) (finder.com) (ONS).

Housing Costs

Housing remains one of the largest expenses for UK residents. In London, for example, the average rent for a three-bedroom apartment in the city center is about £4,425 per month, while outside the city center it averages around £2,863 per month. The cost of purchasing property is also high, with city center prices averaging £1,280 per square foot (Numbeo).

Interest Rates and Mortgages

Interest rates have been raised by the Bank of England to curb inflation, currently standing at 5.25%. This has led to higher borrowing costs, notably affecting mortgage rates and causing significant increases in monthly payments for many homeowners (House of Commons Library) (finder.com).

General Living Expenses

Other living expenses such as fuel, public transport, and food have also seen price increases. Almost all households have reported higher gas and electricity bills, with many also facing higher costs for rent or mortgages, food, and fuel. In response to these rising costs, many UK residents have cut back on non-essential spending, such as dining out, takeaways, and shopping for non-essentials (finder.com) (ONS).

Economic Impact

The rising cost of living has had a significant impact on households, particularly those with lower incomes. Charities like the Trussell Trust have reported a record number of people seeking emergency food parcels, highlighting the financial strain on many families (House of Commons Library).

In summary, while inflation rates have eased somewhat in 2024, the cost of living in the UK remains high due to persistent increases in housing, energy, and general living expenses. The economic impact is felt across all income levels, with lower-income households being the most affected.